Gst And Pst On Food In Saskatchewan . In canada, there is a federal sales tax called the goods and services tax. free online and very simple gst calculator for saskatchewan province. what are gst and pst in saskatchewan? the pst is a 6% sales tax that applies to the purchase, rental or importation of taxable goods and services for consumption or. What is the provincial sales tax (pst) in saskatchewan? calculate the gst (5%) & pst (6%) amount in saskatchewan by putting either the after tax or before tax amount. meals and prepared food and beverages provided in the following circumstances are not subject to pst. Canada imposes a goods and services tax (gst) at the federal. saskatchewan has a provincial sales tax (pst) that is applied on top of the federal goods and services tax (gst).

from www.deskera.com

What is the provincial sales tax (pst) in saskatchewan? Canada imposes a goods and services tax (gst) at the federal. In canada, there is a federal sales tax called the goods and services tax. saskatchewan has a provincial sales tax (pst) that is applied on top of the federal goods and services tax (gst). what are gst and pst in saskatchewan? free online and very simple gst calculator for saskatchewan province. the pst is a 6% sales tax that applies to the purchase, rental or importation of taxable goods and services for consumption or. meals and prepared food and beverages provided in the following circumstances are not subject to pst. calculate the gst (5%) & pst (6%) amount in saskatchewan by putting either the after tax or before tax amount.

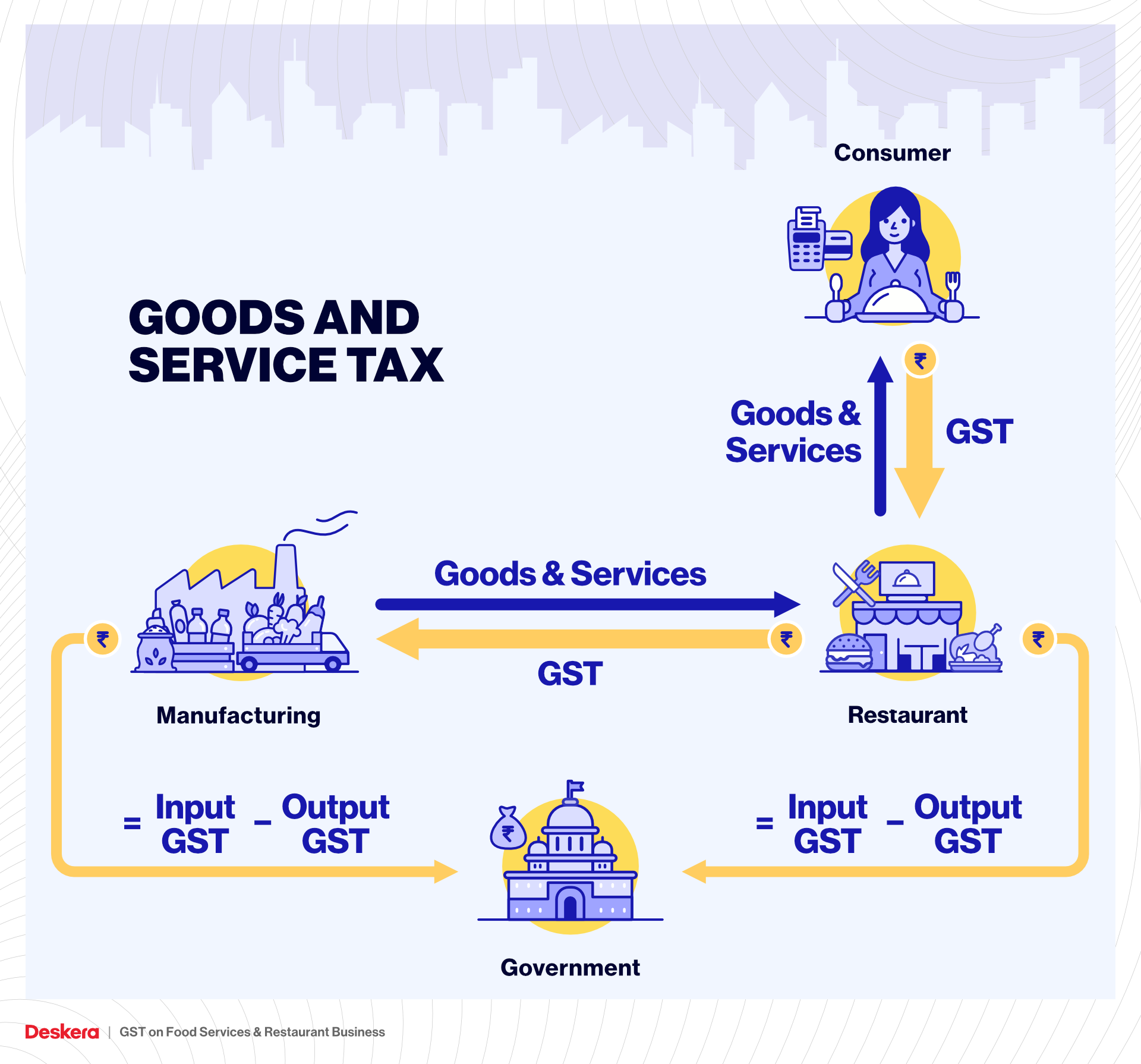

GST on Food Services & Restaurant Business

Gst And Pst On Food In Saskatchewan the pst is a 6% sales tax that applies to the purchase, rental or importation of taxable goods and services for consumption or. what are gst and pst in saskatchewan? the pst is a 6% sales tax that applies to the purchase, rental or importation of taxable goods and services for consumption or. In canada, there is a federal sales tax called the goods and services tax. calculate the gst (5%) & pst (6%) amount in saskatchewan by putting either the after tax or before tax amount. meals and prepared food and beverages provided in the following circumstances are not subject to pst. free online and very simple gst calculator for saskatchewan province. Canada imposes a goods and services tax (gst) at the federal. saskatchewan has a provincial sales tax (pst) that is applied on top of the federal goods and services tax (gst). What is the provincial sales tax (pst) in saskatchewan?

From taxlegit.com

GST on Food and Restaurants in India Regulations and Implications Gst And Pst On Food In Saskatchewan What is the provincial sales tax (pst) in saskatchewan? saskatchewan has a provincial sales tax (pst) that is applied on top of the federal goods and services tax (gst). calculate the gst (5%) & pst (6%) amount in saskatchewan by putting either the after tax or before tax amount. meals and prepared food and beverages provided in. Gst And Pst On Food In Saskatchewan.

From www.youtube.com

Что такое GST/HST/PST и какая между ними разница YouTube Gst And Pst On Food In Saskatchewan what are gst and pst in saskatchewan? What is the provincial sales tax (pst) in saskatchewan? the pst is a 6% sales tax that applies to the purchase, rental or importation of taxable goods and services for consumption or. free online and very simple gst calculator for saskatchewan province. saskatchewan has a provincial sales tax (pst). Gst And Pst On Food In Saskatchewan.

From tutorstips.com

Implementation of GST and Act of GST Example TutorsTips Gst And Pst On Food In Saskatchewan the pst is a 6% sales tax that applies to the purchase, rental or importation of taxable goods and services for consumption or. what are gst and pst in saskatchewan? Canada imposes a goods and services tax (gst) at the federal. In canada, there is a federal sales tax called the goods and services tax. meals and. Gst And Pst On Food In Saskatchewan.

From www.deskera.com

GST on Food Services & Restaurant Business Gst And Pst On Food In Saskatchewan what are gst and pst in saskatchewan? What is the provincial sales tax (pst) in saskatchewan? In canada, there is a federal sales tax called the goods and services tax. saskatchewan has a provincial sales tax (pst) that is applied on top of the federal goods and services tax (gst). meals and prepared food and beverages provided. Gst And Pst On Food In Saskatchewan.

From www.youtube.com

GST, HST, PST Sales Tax for Small Business in Canada Explained YouTube Gst And Pst On Food In Saskatchewan what are gst and pst in saskatchewan? saskatchewan has a provincial sales tax (pst) that is applied on top of the federal goods and services tax (gst). In canada, there is a federal sales tax called the goods and services tax. free online and very simple gst calculator for saskatchewan province. meals and prepared food and. Gst And Pst On Food In Saskatchewan.

From bristax.com.au

GST on Food Gst And Pst On Food In Saskatchewan What is the provincial sales tax (pst) in saskatchewan? Canada imposes a goods and services tax (gst) at the federal. meals and prepared food and beverages provided in the following circumstances are not subject to pst. In canada, there is a federal sales tax called the goods and services tax. calculate the gst (5%) & pst (6%) amount. Gst And Pst On Food In Saskatchewan.

From www.eatthistown.ca

Iconic Foods of Canada Iconic Saskatchewan food Gst And Pst On Food In Saskatchewan meals and prepared food and beverages provided in the following circumstances are not subject to pst. calculate the gst (5%) & pst (6%) amount in saskatchewan by putting either the after tax or before tax amount. What is the provincial sales tax (pst) in saskatchewan? Canada imposes a goods and services tax (gst) at the federal. the. Gst And Pst On Food In Saskatchewan.

From enterslice.com

Do you know the Impact of GST on Food Service & Restaurant Business? Gst And Pst On Food In Saskatchewan meals and prepared food and beverages provided in the following circumstances are not subject to pst. free online and very simple gst calculator for saskatchewan province. Canada imposes a goods and services tax (gst) at the federal. saskatchewan has a provincial sales tax (pst) that is applied on top of the federal goods and services tax (gst).. Gst And Pst On Food In Saskatchewan.

From www.workshopmag.com

A Beginner’s Guide to Charging Sales Tax in Canada Everything Makers Gst And Pst On Food In Saskatchewan What is the provincial sales tax (pst) in saskatchewan? what are gst and pst in saskatchewan? the pst is a 6% sales tax that applies to the purchase, rental or importation of taxable goods and services for consumption or. In canada, there is a federal sales tax called the goods and services tax. free online and very. Gst And Pst On Food In Saskatchewan.

From bristax.com.au

GST on Food Gst And Pst On Food In Saskatchewan what are gst and pst in saskatchewan? What is the provincial sales tax (pst) in saskatchewan? calculate the gst (5%) & pst (6%) amount in saskatchewan by putting either the after tax or before tax amount. meals and prepared food and beverages provided in the following circumstances are not subject to pst. the pst is a. Gst And Pst On Food In Saskatchewan.

From www.askbankifsccode.com

GST on Food and Restaurants Ask Bank Blog Gst And Pst On Food In Saskatchewan saskatchewan has a provincial sales tax (pst) that is applied on top of the federal goods and services tax (gst). calculate the gst (5%) & pst (6%) amount in saskatchewan by putting either the after tax or before tax amount. What is the provincial sales tax (pst) in saskatchewan? the pst is a 6% sales tax that. Gst And Pst On Food In Saskatchewan.

From accounting.mbeforyou.com

Canadian Taxpayer Compass Your Definitive Manual to GST, PST & HST Gst And Pst On Food In Saskatchewan In canada, there is a federal sales tax called the goods and services tax. calculate the gst (5%) & pst (6%) amount in saskatchewan by putting either the after tax or before tax amount. free online and very simple gst calculator for saskatchewan province. saskatchewan has a provincial sales tax (pst) that is applied on top of. Gst And Pst On Food In Saskatchewan.

From wowa.ca

Saskatchewan Sales Tax (GST & PST) Calculator 2024 WOWA.ca Gst And Pst On Food In Saskatchewan saskatchewan has a provincial sales tax (pst) that is applied on top of the federal goods and services tax (gst). the pst is a 6% sales tax that applies to the purchase, rental or importation of taxable goods and services for consumption or. calculate the gst (5%) & pst (6%) amount in saskatchewan by putting either the. Gst And Pst On Food In Saskatchewan.

From studyzonepawlowski.z22.web.core.windows.net

Pst Worksheet Supplement Saskatchewan Gst And Pst On Food In Saskatchewan Canada imposes a goods and services tax (gst) at the federal. what are gst and pst in saskatchewan? What is the provincial sales tax (pst) in saskatchewan? free online and very simple gst calculator for saskatchewan province. meals and prepared food and beverages provided in the following circumstances are not subject to pst. calculate the gst. Gst And Pst On Food In Saskatchewan.

From trainfoodsafety.ca

SASKATCHEWAN Saskatchewan Food Handler Certification Train Food Safety Gst And Pst On Food In Saskatchewan free online and very simple gst calculator for saskatchewan province. what are gst and pst in saskatchewan? saskatchewan has a provincial sales tax (pst) that is applied on top of the federal goods and services tax (gst). In canada, there is a federal sales tax called the goods and services tax. What is the provincial sales tax. Gst And Pst On Food In Saskatchewan.

From caknowledge.com

GST Rate on food and beverages, Rate of gst on Food and Beverages Gst And Pst On Food In Saskatchewan saskatchewan has a provincial sales tax (pst) that is applied on top of the federal goods and services tax (gst). Canada imposes a goods and services tax (gst) at the federal. What is the provincial sales tax (pst) in saskatchewan? the pst is a 6% sales tax that applies to the purchase, rental or importation of taxable goods. Gst And Pst On Food In Saskatchewan.

From www.financialexpress.com

Papad vs Fryum Why do you end up paying more for some food items and Gst And Pst On Food In Saskatchewan In canada, there is a federal sales tax called the goods and services tax. Canada imposes a goods and services tax (gst) at the federal. calculate the gst (5%) & pst (6%) amount in saskatchewan by putting either the after tax or before tax amount. free online and very simple gst calculator for saskatchewan province. What is the. Gst And Pst On Food In Saskatchewan.

From swaritadvisors.com

Applicability of GST on Food Industry Swaritadvisors Gst And Pst On Food In Saskatchewan In canada, there is a federal sales tax called the goods and services tax. saskatchewan has a provincial sales tax (pst) that is applied on top of the federal goods and services tax (gst). the pst is a 6% sales tax that applies to the purchase, rental or importation of taxable goods and services for consumption or. . Gst And Pst On Food In Saskatchewan.